15 percent of PGGM investments are now SDG-aligned

Over 15 percent of PGGM’s investment portfolio contributes to the sustainable development goals of the United Nations (UN). We recently presented this in PGGM’s annual responsible investing report 2018. This represents 33.8 billion euros in investments in businesses and projects that offer solutions for the biggest challenges facing society worldwide. The UN has translated solutions for these challenges into 17 goals: the UN Sustainable Development Goals (SDGs). We call the investments in the SDGs Sustainable Development Investments: SDIs.

PGGM does not consider this SDI volume the final result, however. It is merely a first step in determining our impact: the tangible contribution our investments make to a more sustainable world.

Simply putting an SDG label on investments and tallying them up does not change anything. We are working on reducing the negative impact that investments can have on the world, on increasing the positive impact and measuring these impacts: have our investments actually made a net contribution towards achieving the SDGs?

Sustainable solutions

To find out, we first identified which products and services from businesses can be considered sustainable solutions. Together with APG, we published the ‘SDI Taxonomies’ in 2017; this is a classification system with investible solutions for each SDG.

Alongside these taxonomies, we also developed rules for decision-making: under what conditions and in what circumstances does a business deliver solutions that are actually sustainable? In 2018 we then reviewed the investment portfolio alongside these SDI taxonomies and decision rules and used this framework to identify the SDIs in the portfolio.

The SDI volume expresses how many euros are invested in companies and projects that are contributing to the SDGs. As stated, this does not yet make clear what the actual impact of these investments is.

Measuring positive tangible impacts - such as the number of kWh of renewable energy generated, the number of cubic metres of water saved or the number of lives prolonged - is something we already have been doing for our Investments in Solutions for the last four years. These are investments that contribute to four social themes which translate to 5 of the 17 SDGs: climate change (SDG 7) and pollution (SDG 12), water scarcity (SDG 6), food security (SDG 2) and healthcare (SDG 3).

We do not yet measure impact for the other SDIs. This is a necessary step in the future to be able to determine our real contribution to sustainable development.

The results

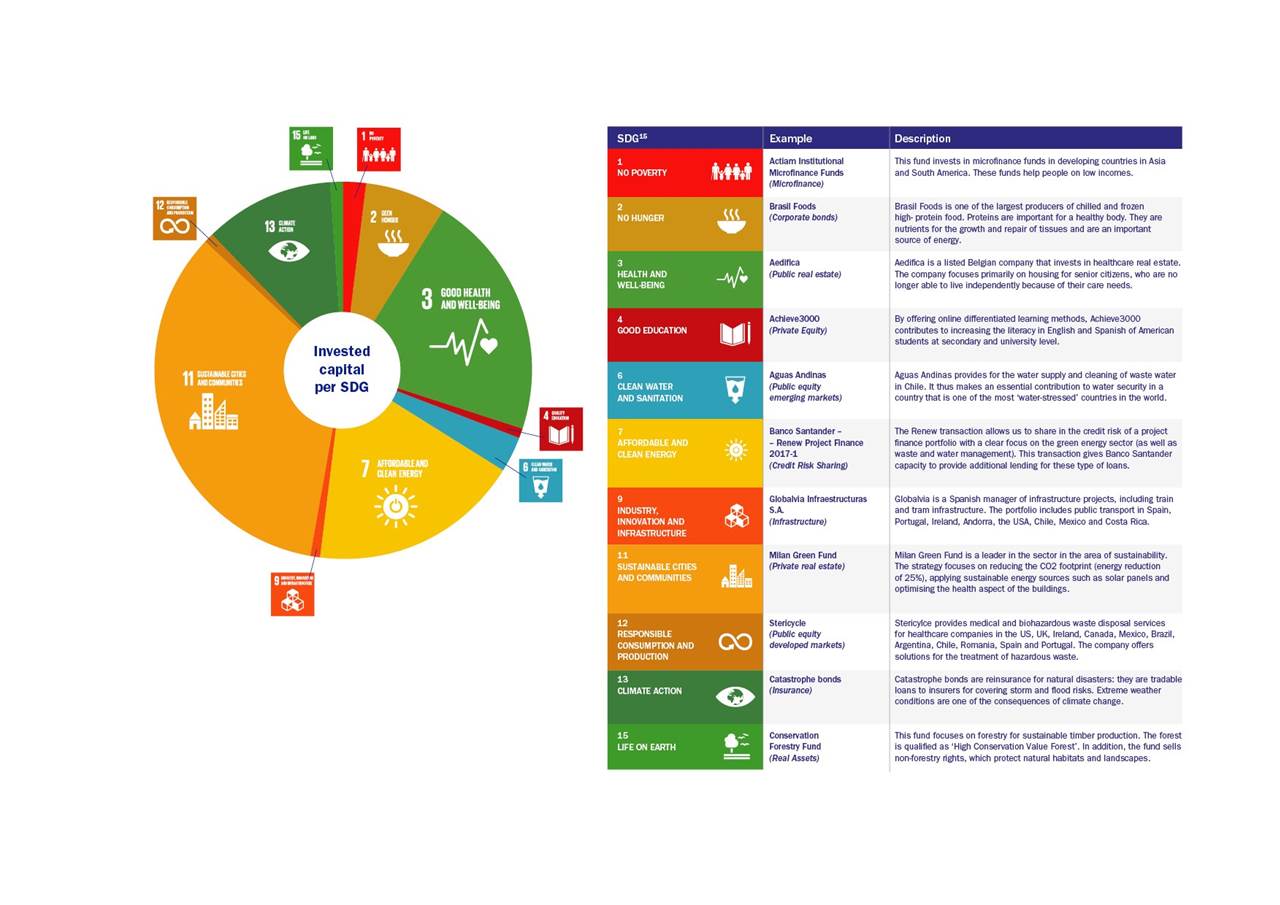

Much of the SDI volume of 33.8 billion euros is invested in real estate (SDG 11: Sustainable cities and communities). Another large part of the SDI volume is invested in healthcare (SDG 3: Health and well-being) and in solutions for the climate (SDG 7: Affordable and clean energy and SDG 13: Climate action). The figure below gives an overview of the distribution of the SDI volume across the various SDGs.

The figure shows that the investments do not cover all 17 SDGs: SDGs 5, 8, 10, 14, 16 and 17 are missing. This is because we were unable to find many, if any, investible solutions for these, or at least not in terms of products and services.

Therefore, SDI is limited to solutions via products and services. We have made a few exceptions to this: sometimes a company makes such a large contribution to one or more SDGs, but does not do so via a product or service but via its business operations, that we have designated this company an ‘Acknowledged Transformational Leader’ (ATL).

How did we identify SDIs?

As a predominantly passive investor in listed companies, we need sustainability data from an enormous number of companies. That is why we used data supplier Vigeo Eiris, which has analysed a large number of listed companies for their contribution to sustainable development. For other asset classes in which we invest actively, we performed the SDI classification ourselves.

SDI classification may sound simple, but it certainly is not. In practice, we came up against many challenges. We discuss the three main challenges below.

Challenge 1: weighing positive against negative impacts

The world of sustainable solutions is not black and white, or even ‘grey and green’. It is often not immediately clear which SDGs a company may be contributing to. For example: artificial fertiliser contributes to food security because it ensures higher agricultural yields. This is sorely needed for the rapidly growing world population. At the same time, the production of artificial fertiliser causes a high volume of CO2 emissions and overuse causes water pollution. So is artificial fertiliser a sustainable solution?

Most businesses and projects have both a positive and negative impact. It is a challenge to weigh these against each other. Another example: electric cars contribute to lower CO2 emissions, but batteries, one of the essential components of these cars, cause chemical waste. That is harmful for the environment. Human rights and labour rights are also often violated in the mines where lithium and cobalt, the raw materials for batteries, are mined.

There is no unequivocal answer to the question of whether electric cars and artificial fertiliser are ‘good’ or ‘bad’, therefore. In this initial SDI classification, we focused mainly on the positive contributions of products and services. In future measurements, we want to include the negative impacts more effectively.

Challenge 2: lack of data

Perhaps the biggest challenge was the lack of data on how products and services contribute to the SDGs. Not many companies report on this themselves yet. Little is also reported on the extent to which sustainable products and services contribute to revenue. We use these figures to determine what percentage of our investment in the company can be counted as SDI.

Companies report even less on the context in which they operate. It is therefore often difficult for investors to get information about the physical surroundings, the chain and the end user. A product may, in theory, seem to be a solution, but in practice it might not actually provide a solution because it is unaffordable for the people who need it most. Take education, for instance: there are many educational institutions that are private and expensive, which makes them inaccessible for many.

Finally, data availability is not always consistent. This differs from asset class to asset class. For Infrastructure, for instance, we have access to detailed reports from the funds and projects in which we invest and we are very familiar with the investments. This is often more difficult for Private Equity, for example: we know the fund managers well but have less insight into the alignment with the SDGs at a company level.

Challenge 3: sustainability is (fortunately!) developing quickly

A final challenge worth mentioning is that the world of sustainable solutions is developing rapidly. Innovation and regulation can mean that products and services we considered sustainable yesterday are already being replaced with better alternatives today. Likewise, products that are unknown to us today could be put on the market tomorrow as sustainable solutions.

Because of these and other challenges, the SDI volume we reported is not definitive. The volume may in fact change in the years to come, not only because of the changing composition of the portfolio, but also because of technological developments or better sustainability data. A better classification method on which we will continue to work in the coming years can result in this too. By publishing the SDI volume, we send the signal to businesses and the financial sector that along with the risk and return of our investments, we believe the impact of our investments is also important. That is our real contribution to the SDGs.

Authors: Rui Chang and Pleuni de Kind

Share or Print Article

click on the icon