A New Standard in Credit Investing

Together with our client PFZW, we aim for an investment portfolio in which return, risk and sustainability are equally important - delivering market-conform returns, against an acceptable risk level, and with a relative high sustainability profile. The asset class Credit is the first domain in which this integrated vision has been fully implemented. In this article we outline our journey on how we have balanced the portfolio: from initial concept to practical execution.

Credit is well aligned with PFZW’s new investment strategy. The portfolio is actively managed, meaning in-depth knowledge on investee companies is already embedded in the investment process. Given the asymmetric risk-return profile of credit investments, company selection is essential to avoid losses in the portfolio.

From Strategic Ambition to Concrete Investment Choices

In 2023, we started developing a credit portfolio for PFZW in which sustainability is given equal weight alongside return and risk. This resulted in a prototype based on a clearly defined investment philosophy. Today, this prototype forms the blueprint for our global approach of credit investing as part of PFZW’s new credit mandate.

Two key strategic decisions made this possible:

1. A Single Global Investment Universe

We decided to no longer work with separate regional or sector allocations. Instead, we operate within one broad, global investment universe. This approach increases the number of potential investments that meet our goals for return, risk and sustainability goals. A global perspective enables clearer trade-offs across all three dimensions.

2. A Longer Investment Horizon

To improve the sustainability angle of the credit portfolio without concessions to return expectations, it requires a long-term perspective. Accordingly, we have extended the investment horizon from 3–5 years to 5–7 years. This provides the scope to implement strategies that deliver value over the longer term — both financially and socially.

A Structured Approach to Sustainability

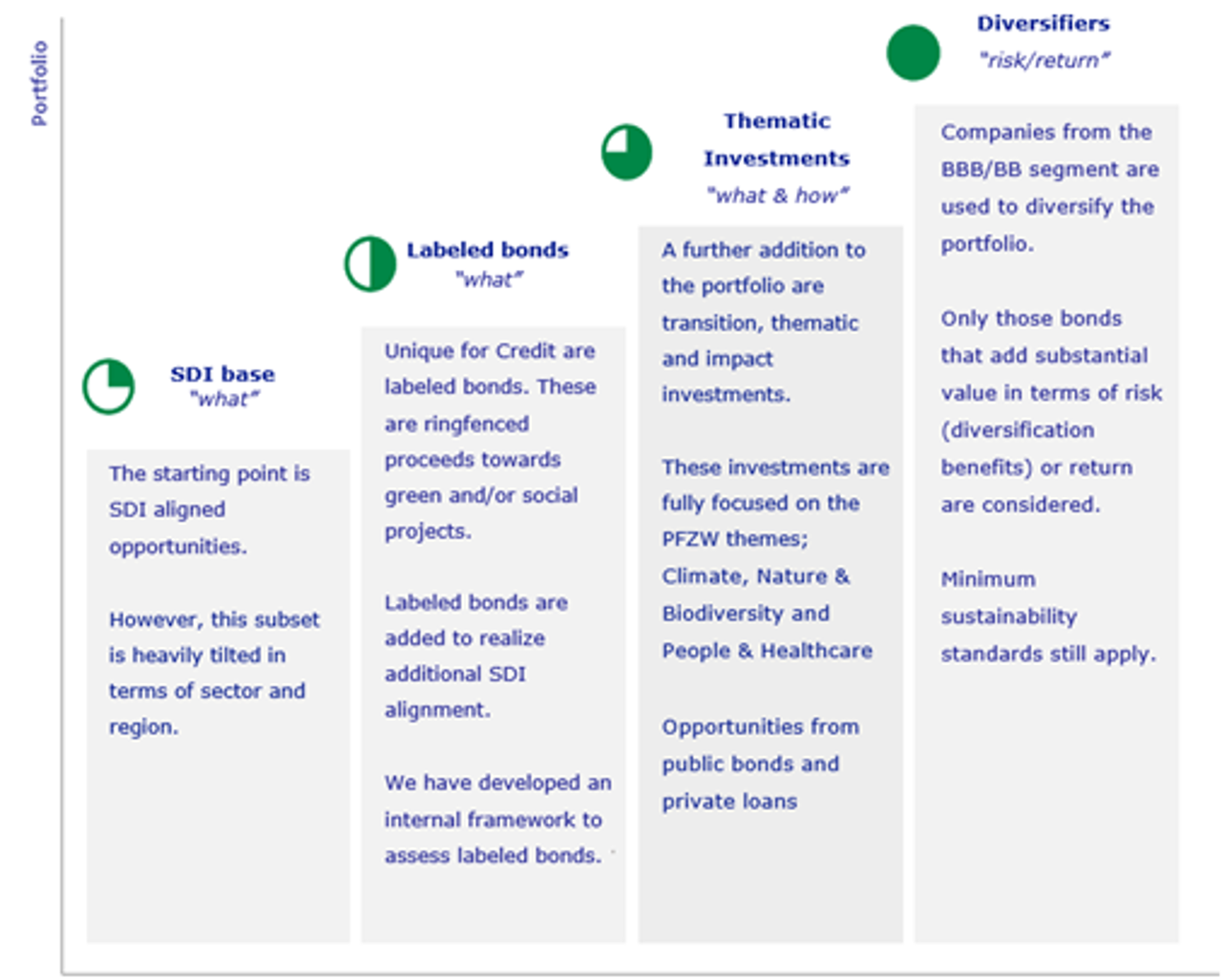

Our sustainability approach is based on four complementary pillars:

1. SDI-Based Selection

We target companies that demonstrably contribute to the Sustainable Development Goals (SDGs) through their products and services. This approach, widely embedded across PGGM, supports PFZW’s objective to allocate 30% of the portfolio to Sustainable Development Investments (SDIs) by 2030. SDIs are assessed by ENTIS, the SDI Asset Owner Platform co-founded by PGGM. This focus results in sector concentrations—particularly in healthcare and utilities. We therefore use the other three pillars to a) further increase our sustainability contribution, and b) actively manage the portfolio risk and return.

2. Labelled Bonds

Labelled bonds represent a unique investment opportunity within credit. These instruments earmark dedicated proceeds for green and/or social projects (‘use of proceeds’). Via our internally developed framework on labelled bond issuance, we apply criteria to ensure the companies meet our minimum sustainability standards. Labelled bonds enable targeted sustainability outcomes—even in companies that do not yet meet SDI criteria at the corporate level—broadening the investable universe without compromising on return or risk.

3. Thematic Loans with an Impact Component

The mandate also allows for private loans aligned with PFZW’s three key themes: climate, biodiversity and health. Through direct agreements with companies, we fund innovative impact projects. For example, we invested in a Swedish steel producer employing green hydrogen technology.

4. Diversifiers for a Balanced Portfolio

As described earlier, careful risk-return assessment is vital. That is why we continue to invest in companies that meet our minimum sustainability standards (such as the OECD Guidelines, Global Compact principles and product exclusions like tobacco) but that cannot (yet) be classified as sustainable investments. These ‘diversifiers’ help manage risk and reduce sector concentration. Where appropriate, they also provide opportunities to engage with companies and improve their sustainability profile over time.

The four complimentary pillars in a nutshell

Substantiating Sustainability with Measurable Criteria

To ensure our investments meet sustainability objectives, we apply an internally developed 'sustainability assessment'. This analysis combines insights into a company’s product and/or services (‘what’) with its behaviour and practices (‘how’). We evaluate factors like climate targets and social standards but also industry-specific issues like data security and waste or water management.

Each company is assessed relative to its peers, using our own research and judgement, supported by external benchmarks. Most importantly, our decisions must be explainable and aligned with the joint ambitions of PGGM and PFZW.

A Future-Proof Credit Portfolio

Using this approach, we are building a global credit portfolio where return, risk and sustainability are balanced and mutually strengthened. The outcome is a well-structured portfolio embedded with fundamental analysis, demonstrating that sustainability is not a precondition, but a fully integrated part of the investment process.

Share or Print Article

click on the icon